Trump’s 401(k) Overhaul Could Bring Crypto and Gold Into Focus

Opening 401(k) Plans to Alternative Assets

A new era of retirement investing may be on the horizon. On August 7, 2025, President Trump signed a landmark executive order that could radically reshape how Americans save for retirement. The order calls for updated regulations that would enable 401(k) plans to include alternative assets - notably precious metals like gold and silver, as well as digital currencies such as Bitcoin.

This policy shift has the potential to unlock massive demand for physical gold while transforming how investors view portfolio diversification within retirement accounts.

What the Executive Order Means

The executive directive instructs the Department of Labor (DOL) and Securities and Exchange Commission (SEC) to revisit outdated rules that currently limit 401(k) plans to conventional assets like mutual funds, stocks, and bonds.

The proposed change could give plan sponsors the green light to offer allocations in:

🔹 Physical precious metals (gold, silver, platinum)

🔹 Cryptocurrencies and stablecoins

🔹 Private equity and infrastructure funds

If adopted, this would mark one of the most significant overhauls of the U.S. retirement system in decades.

Precious Metals: A New Frontier for Retirement Savers

Gold and silver have long been regarded as hedges against inflation, currency risk, and economic instability - yet most 401(k) participants have had little to no access to them.

Here’s how the executive order could change that:

1. Expanded Demand for Physical Bullion

Institutional exposure to gold could surge, especially if major retirement plan providers begin offering allocated gold-backed funds or vault-stored bullion options. Even a small percentage shift could send gold prices soaring.

2. Improved Access to IRA-Approved Metals

Popular IRS-compliant options - such as American Gold Eagles, 1 oz gold bars, and silver bullion - could become central to retirement portfolios, especially if 401(k)s align with existing self-directed IRA rules.

3. Strengthened Case for Hard Assets

With rising national debt and persistent inflation, more investors may seek tangible, non-correlated assets. The new rules would legitimize gold’s place as a long-term store of value.

Cryptocurrency’s Role: Opportunity and Uncertainty

While the precious metals market may benefit from greater stability and existing custodial infrastructure, crypto assets face a different road ahead:

🔹 Volatility concerns may limit exposure for some plans

🔹 Custody and insurance standards remain underdeveloped

🔹 However, Bitcoin ETFs and digital asset trust structures may pave the way for inclusion

Still, if implemented properly, the order could enhance crypto’s institutional standing and fuel another wave of adoption.

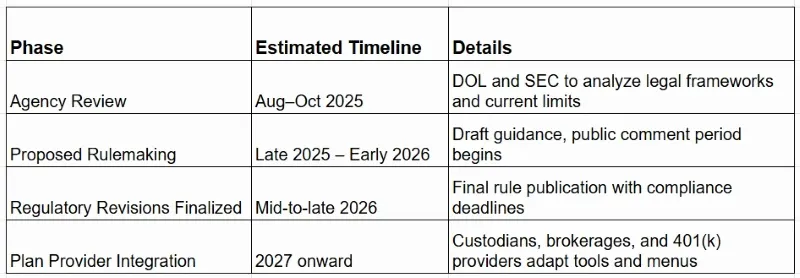

Anticipated Rollout Timeline

The order is just the beginning. A structured regulatory process must follow before any changes appear in retirement accounts. Here’s a likely progression:

Investors should stay alert, as early adopters and self-directed accounts may be able to leverage new structures before widespread rollout.

Potential Challenges Ahead

While the opportunity is significant, several hurdles must be cleared:

🔹 Fiduciary Duty: Plan sponsors must prove that alternative assets serve the best interests of participants.

🔹 Transparency: Gold and crypto offerings will need clear disclosures about fees, volatility, and liquidity.

🔹 Custody Requirements: Only IRS-compliant storage and third-party vaults will be eligible for physical gold.

Still, gold’s traceability, verifiable purity, and global liquidity give it a strong edge over more volatile assets in gaining regulatory favor.

Market Outlook: How Will Gold Respond?

If access to gold becomes widespread in 401(k)s, the following market impacts are likely:

🔹 Price Tailwinds: Broader investor access could tighten supply and push prices higher.

🔹Increased Mint Demand: Popular bars and coins from trusted mints may see sharp upticks in production.

🔹Storage Industry Growth: Vault services could expand as more investors seek insured, segregated holdings.

Alpha Bullion anticipates a growing role for bullion in diversified retirement strategies - especially as confidence in fiat systems continues to erode.

A Golden Opportunity for the Future

President Trump’s executive order may not transform retirement overnight, but it clearly signals a philosophical shift: giving Americans more freedom to invest in what they believe will protect their future.

Gold and silver aren’t just historical relics - they are emerging as modern tools for retirement resilience. And with inflation high, interest rates uncertain, and digital assets still finding their footing, now may be the perfect time to consider how precious metals could enhance your long-term wealth strategy.

At Alpha Bullion, our mission is to empower investors with timely insights, in-depth analysis, and the knowledge needed to navigate this evolving retirement landscape with clarity and confidence.

Other articles that may interest you:

July CPI: Crypto and Digital Gold Lead Market Focus

How to Test Gold at Home: Reliable Methods Explained