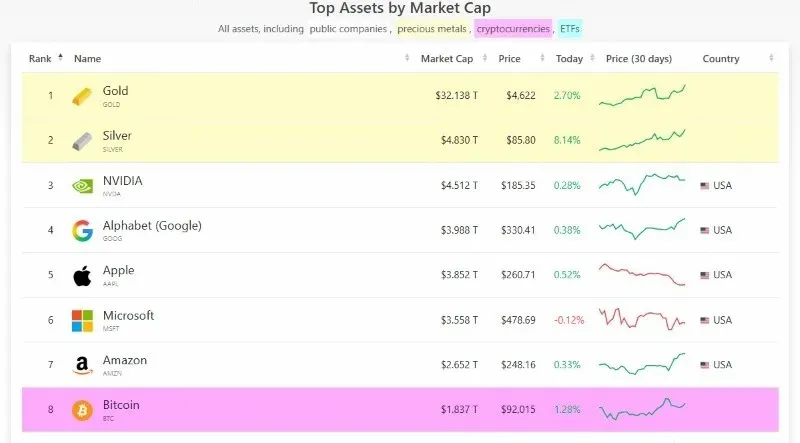

Gold and Silver Ranked #1 and #2 by Global Market Cap

Why Tangible Assets Continue to Command the World’s Capital

In a global market dominated by equities, technology innovation, and digital finance, two traditional assets continue to stand above all others: gold and silver. Measured by market capitalization, these precious metals now represent the largest pools of value worldwide, exceeding even the biggest publicly traded corporations. This ranking reflects more than market performance—it highlights the enduring role of physical assets in preserving wealth across generations.

As economic uncertainty persists, investors appear to be reaffirming confidence in assets with intrinsic value and long-established trust.

Using Market Capitalization to Compare Unlike Assets

Market capitalization provides a way to evaluate the total value of an asset in circulation. While commonly applied to stocks, the same principle can be extended to commodities and digital assets. For precious metals, market cap is calculated by combining current spot prices with estimates of existing above-ground supply.

This metric allows investors to place gold, silver, stocks, and cryptocurrencies on a single comparative scale. When gold and silver emerge at the top, it suggests that global capital continues to gravitate toward assets viewed as durable and universally recognized.

Gold’s Enduring Role as a Monetary Anchor

Gold’s position as the world’s most valuable asset underscores its reputation as a financial constant. The price of gold reflects sustained demand from central banks, institutions, and individuals seeking insulation from inflation, currency depreciation, and geopolitical instability.

Because gold exists outside the credit system and carries no counterparty risk, it functions as a form of financial insurance. Its global acceptance and limited supply continue to support its dominance in total market value.

Silver’s Strength Comes from Versatility

Silver’s rise to the second-largest asset by market capitalization is driven by its unique combination of roles. As an investment metal, silver attracts buyers during periods of uncertainty. As an industrial material, it is essential to sectors such as renewable energy, electronics, healthcare, and transportation.

The price of silver is influenced by this dual demand profile, making it especially sensitive to both economic growth and technological expansion. Unlike gold, much of silver’s supply is consumed, contributing to long-term supply tightness and sustained value.

Why Precious Metals Outrank Corporate Giants

That gold and silver surpass companies like Microsoft, Amazon, and NVIDIA in market capitalization highlights a fundamental difference in asset behavior. Corporate valuations depend on future earnings, regulation, and competitive positioning. Precious metals, by contrast, derive value from physical scarcity and centuries of monetary relevance.

This distinction helps explain why metals often rise in prominence during periods of economic transition or financial stress.

Bitcoin’s Position Among Global Assets

Digital assets have secured a meaningful place within the global asset hierarchy, with Bitcoin currently ranking #8 by market capitalization, placing it among the most valuable assets worldwide. Often compared to gold due to its fixed supply and decentralized structure, Bitcoin has attracted investors looking for alternatives to traditional fiat currencies and inflation-sensitive assets. Its appeal is driven in part by scarcity, with a capped supply that cannot be expanded by governments or central banks.

Despite these similarities, Bitcoin differs significantly from precious metals. Gold and silver benefit from thousands of years of monetary history, physical tangibility, and near-universal recognition as stores of value. They do not rely on digital infrastructure, energy networks, or evolving regulatory frameworks to maintain their function. As a result, many investors view cryptocurrencies as complementary diversification tools rather than direct substitutes for physical gold and silver, using digital assets alongside precious metals to balance modern innovation with time-tested stability.

Central Banks, Supply, and Long-Term Value

Central bank activity plays a significant role in gold’s continued dominance, with ongoing purchases reinforcing confidence in the metal’s monetary role. Silver faces a different dynamic, where constrained mine output and rising industrial demand place pressure on available supply.

Together, these forces support the long-term valuation of both metals and contribute to their leading positions by market capitalization.

What This Means for Investors Today

Market cap rankings offer investors insight into where global capital is concentrated. Gold and silver’s positions at the top suggest liquidity, stability, and trust—qualities that are critical during periods of volatility.

Rather than competing with growth assets, precious metals often serve as stabilizing counterparts, helping diversify portfolios and reduce overall risk.

A Clear Signal from Global Markets

Gold and silver’s dominance by market capitalization reflects a continued preference for tangible value in an increasingly complex financial world. While innovation and digital assets shape the future, physical precious metals remain central to how wealth is stored and protected.

For investors assessing long-term strategies, the leading positions of gold and silver reinforce their role as foundational assets—trusted not because of trends, but because of time-tested reliability.

Data table sourced from: companiesmarketcap.com

Related reading you may find interesting:

Gold and Silver Demand Is Redefining Precious Metals Operations