Gold-Backed Tokens Surge as Tether and PAX Gold Cross $1 B

A New Era in Gold’s Digital Evolution

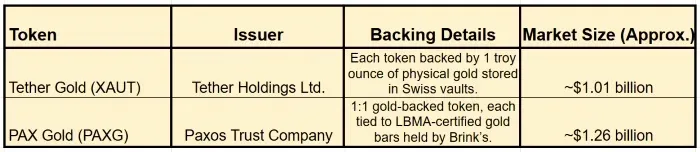

As gold prices reach historic highs in 2025, digital gold tokens like Tether Gold (XAUT) and PAX Gold (PAXG) are gaining extraordinary traction among investors worldwide. Both have now surpassed billion-dollar milestones — with Tether Gold’s market capitalization exceeding $1 billion and PAX Gold currently valued at approximately $1.26 billion (as of mid-October 2025, per CoinMarketCap). Together, these blockchain-based bullion assets represent a powerful new frontier in precious-metal investing — where physical gold meets digital access.

This surge highlights growing demand for instruments that combine the security of real gold with the speed and flexibility of blockchain technology. As inflation concerns persist and global markets remain volatile, investors are turning to gold-backed digital assets as a bridge between time-tested value and next-generation innovation.

Why Gold-Backed Tokens Are Gaining Investor Momentum

Gold-backed cryptocurrencies such as XAUT and PAXG are drawing capital from both institutional and retail markets. Several key factors are driving this rise:

1. Seamless, Physically-Backed Access to Gold

Each token represents ownership of real, allocated gold bars stored in secure vaults — typically in Switzerland or London — fully verifiable through published serial numbers, weights, and purity documentation.

🔹 This transparency allows investors to hold legally recognized, physically backed gold without the traditional burdens of shipping, storage, or insurance.

2. Rising Demand Across All Gold Channels

The tokenized gold boom parallels strong momentum across ETFs, retail bullion, and industrial demand.

🔹 From record central-bank purchases to surging jewelry consumption, nearly every segment of the gold market is fueling a self-reinforcing cycle of demand that benefits both physical and digital gold alike.

3. A Global Flight to Safety

Persistent inflation, currency instability, and geopolitical tension continue to push investors toward hard assets.

🔹 Gold’s role as a safe-haven hedge remains unmatched — and tokenized gold now delivers that protection with the added benefits of 24/7 tradability and global accessibility.

Tether Gold vs. PAX Gold: The Leaders in Tokenized Bullion

Both tokens have established themselves as the top digital gold assets in circulation. Tether Gold’s momentum underscores investor appetite for highly portable exposure to bullion, while PAX Gold remains a benchmark for transparency and regulatory compliance within the crypto-commodities sector.

While market capitalization reflects token valuation rather than exact gold holdings, the growing scale of both projects underscores one clear message: tokenized gold is moving firmly into the mainstream.

How Tokenized Gold Fits into Today’s Market

Gold’s digital transformation complements, rather than replaces, physical bullion. Investors now have a range of vehicles to gain exposure to gold’s ongoing rally:

🔹 Physical bullion — Coins, bars, and rounds for long-term, tangible wealth preservation.

🔹 ETFs and futures — Institutional products offering liquidity and large-scale exposure.

🔹 Tokenized gold — Digitally transferable ownership of physically backed gold for 24/7 trading and global accessibility.

With gold prices holding above $4,100 per ounce, these demand channels — industrial, retail, ETF, and tokenized — are collectively reinforcing upward pressure on the metal. This convergence is a major reason analysts expect continued strength in precious metals through the remainder of 2025.

What Tokenized Gold Means for Investors in 2025

For modern investors, gold-backed tokens represent an evolution in how physical assets are owned and managed.

They offer:

🔹 Accessibility: Gold exposure that can be traded or transferred globally in minutes.

🔹 Transparency: On-chain verification tied to documented, vaulted bars.

🔹 Fractional ownership: Lower entry thresholds for gold investors.

🔹 Diversification: A way to blend digital liquidity with traditional security.

Still, prudent investors should always evaluate custodial arrangements, auditing standards, and issuer reputation before buying. Tokenized gold is transformative, but maintaining due diligence is essential to ensure long-term confidence and safety.

The Bottom Line: Gold’s Dual Renaissance

The success of Tether Gold and PAX Gold marks a dual renaissance in the precious-metals world — physical and digital. While traditional investors continue to accumulate coins and bars as inflation hedges, a new generation of participants is embracing blockchain-based gold for its portability, transparency, and borderless efficiency.

As these two approaches converge, they’re fueling synchronized demand that supports record-high gold prices and broadens market participation. Whether held in a vault or secured on the blockchain, gold’s timeless role as a store of value remains as compelling — and as relevant — as ever.

Related reading you may find interesting:

Tether’s XAUt0 and the Rise of Gold-Backed Stablecoins

Fractional Gold vs. Crypto Tokenization: Future of Accessible Wealth