Tether’s XAUt0 and the Rise of Gold-Backed Stablecoins

Why Gold-Backed Stablecoins Matter Now

In 2025, both the gold market and the stablecoin sector are breaking records. Spot gold trades above $3,600 per ounce, while the global stablecoin market is nearing $300 billion, with Tether’s USDT holding more than half of that share. Against this backdrop, gold-backed stablecoins are emerging as a unique bridge between traditional safe-haven assets and digital finance.

Tether’s introduction of XAUt0, the omnichain upgrade to Tether Gold (XAUt), highlights how blockchain technology and precious metals are converging to create new opportunities for investors worldwide.

What Is a Gold-Backed Stablecoin?

A gold-backed stablecoin is a digital token issued on a blockchain that represents direct ownership of physical gold. Each token is typically pegged 1:1 to a specific weight of gold, stored in secure vaults and verified by the issuer. Unlike fiat-backed stablecoins, which rely on traditional currency reserves, these tokens derive value from gold’s enduring scarcity and role as a hedge against inflation.

For investors, gold-backed stablecoins provide the portability and liquidity of crypto while maintaining the stability and intrinsic value of bullion. They can be traded globally, used in decentralized finance (DeFi), or redeemed for the underlying metal—making them a versatile tool in both modern digital portfolios and traditional wealth strategies.

From Tether Gold (XAUt) to XAUt0: What Changed?

🔹Tether Gold (XAUt): Launched in 2020, this token is backed 1:1 by physical gold stored in Swiss vaults. By mid-2025, it had a market cap of around $880 million, representing about 7.7 metric tons of gold.

🔹XAUt0: Released in June 2025, this new version uses LayerZero’s Omnichain Fungible Token (OFT) protocol, enabling seamless transfers across multiple blockchains. Unlike wrapped tokens or bridges, XAUt0 is designed to move freely between chains with fewer risks and costs.

Together, these products position Tether as the leading issuer not only of dollar-pegged stablecoins but also of digitally native gold assets.

Tether’s Expanding Gold Ambitions

Recent reports indicate that Tether is exploring direct investments in the gold industry — spanning mining, refining, and trading. This suggests a potential vertical integration strategy that could strengthen both the credibility and utility of its gold-backed products.

Coupled with its 100,000+ Bitcoin reserve holdings, Tether is clearly aligning itself with hard assets that can reinforce trust in its ecosystem.

XAUt0 vs. Paxos Gold (PAXG): A Comparison

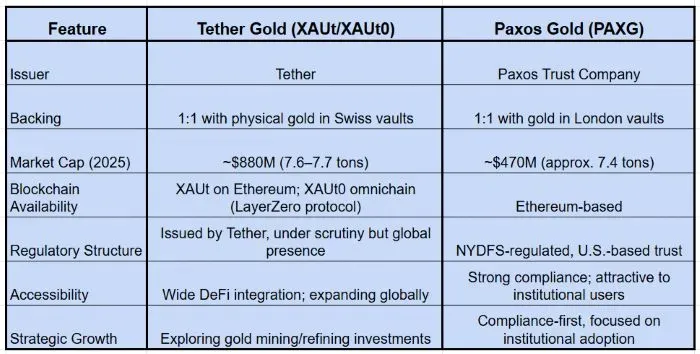

🔹Tether Gold/XAUt0 emphasizes accessibility and innovation, with cross-chain features that appeal to retail users and DeFi participants.

🔹PAXG focuses on regulatory compliance and institutional trust, making it a natural fit for banks, funds, and conservative investors.

Practical Use Cases for Gold-Backed Stablecoins

🔹Hedging Inflation: Combine blockchain liquidity with gold’s role as an inflation hedge.

🔹DeFi Integration: Use as collateral, lending assets, or trading pairs in decentralized finance.

🔹Diversification: Add exposure to precious metals without the logistics of physical storage.

🔹Global Access: Provides 24/7 access to gold markets, even in regions with limited bullion infrastructure.

Risks Investors Should Consider

While gold-backed stablecoins offer unique advantages, they also carry risks:

🔹Custodial Dependence: Investors must trust that the issuing company holds the underlying gold as promised.

🔹Regulatory Uncertainty: Tether faces more scrutiny than Paxos, which is tightly regulated in New York.

🔹Liquidity Differences: XAUt0 may trade actively in DeFi, while PAXG has more depth in regulated institutional channels.

🔹Premium/Discount Risks: Market prices of tokens can diverge slightly from spot gold depending on demand.

Macro Trends Supporting Digital Gold

Several global trends amplify the appeal of gold-backed stablecoins:

🔹Central Bank Buying: Governments continue adding gold to reserves, underscoring its enduring role as a monetary anchor.

🔹De-Dollarization Pressure: Some countries are seeking alternatives to dollar trade settlement, making gold-pegged assets more relevant.

🔹Crypto Institutionalization: As crypto becomes mainstream, hybrids like gold-backed stablecoins are gaining traction as both safe assets and blockchain-native tools.

The Future: Could Gold-Backed Stablecoins Go Mainstream?

Looking ahead, gold-backed stablecoins could play a role in central bank digital currencies (CBDCs) or cross-border payment networks, offering a compromise between fiat currencies and decentralized assets. Tether’s potential entry into the physical gold industry may accelerate this shift by linking blockchain tokens directly with supply chain control.

The Digital Gold Race

Tether’s XAUt0 signals the next phase of gold’s digital evolution. By combining blockchain innovation with precious metals, Tether is positioning itself at the center of a market that blends traditional value with modern efficiency. Meanwhile, Paxos Gold (PAXG) remains the benchmark for regulated, institution-friendly gold tokens.

For investors, the key takeaway is clear: whether through XAUt0’s omnichain flexibility, PAXG’s compliance-first model, or physical bullion itself, gold is rapidly finding new life in the digital era.

Other articles that may interest you:

Red September: Why Crypto Markets Are Under Pressure This Month

Gold-Backed Tokens Surge as Tether and PAX Gold Cross $1 B