Tokenized Gold Is on the Rise: What Investors Need to Know

Blending Bullion with Blockchain: A New Era of Gold Ownership

As gold continues to serve as a trusted store of value, a new digital frontier has emerged - tokenized gold. By combining physical bullion with blockchain technology, tokenized gold offers investors the security of real assets and the flexibility of digital finance. In 2025, demand for gold-backed tokens is rising fast, fueled by inflation concerns, market innovation, and growing institutional interest. This guide explores how tokenized gold works, why it’s gaining traction, and what it means for the future of precious metals investing.

What Is Tokenized Gold?

Tokenized gold is a digital representation of real, physical gold issued on a blockchain. Each token is backed 1:1 by a specific amount of bullion - typically one troy ounce - and can be bought, sold, or held like any cryptocurrency. Behind the token lies audited gold stored in a secure vault, with redemption options depending on the issuer.

Tokenized gold offers:

🔹 True ownership of physical gold

🔹 Blockchain-level liquidity and transparency

🔹 24/7 global trading without intermediaries

It’s not a gold ETF, nor a gold derivative. It’s real gold - tokenized.

A Brief History of Tokenized Gold

While the concept has gained mainstream attention recently, the idea of tokenizing real-world gold dates back nearly a decade. One of the earliest projects was Digix Gold (DGX), launched in 2016 by a Singapore-based team. DGX pioneered gold-backed tokens (1 token = 1 gram), with reserves stored in The Safe House vault in Singapore.

Though DGX established tokenized gold as a viable concept, the project shut down in 2020. Its tokens are no longer redeemable or supported. Despite this, DGX’s role remains important - it paved the way for today’s more secure, regulated, and scalable gold token platforms.

Why Tokenized Gold Demand Is Rising in 2025

1. Safe-Haven Appeal Meets Blockchain Utility

Amid inflation, fiat currency devaluation, and global uncertainty, gold remains a store of value. But modern investors - especially millennials and Gen Z - gravitate toward digital assets. Tokenized gold merges both worlds, offering real metal with blockchain flexibility.

2. Institutional Adoption Is Accelerating

Major institutions like BlackRock, Franklin Templeton, and JPMorgan are expanding into tokenized real-world assets (RWAs), including gold. JPMorgan’s Onyx blockchain has tested tokenized gold for collateral and settlement, while platforms like Paxos have seen tokenized gold volumes surge.

3. Real-World Asset (RWA) Boom

Tokenized gold is part of a wider wave of blockchain-based RWAs. In 2025, tokenization now extends to:

🔹 Real estate (fractional ownership)

🔹 U.S. Treasuries and corporate bonds

🔹 Luxury goods (art, watches, wine)

🔹 Commodities (silver, oil, platinum)

According to BCG, tokenized assets may reach $16 trillion by 2030 - with gold serving as the anchor.

What Makes a Gold Token Trustworthy?

The failure of early tokens like DGX showed that without transparency, regulation, and custody controls, trust cannot be sustained. Today’s top gold tokens - like PAXG and XAUT - operate under vastly improved frameworks.

Before investing, assess each gold token by:

🔹 Redemption terms – Can it be converted to physical gold? What’s the minimum?

🔹 Vault transparency – Where is the gold stored? Are audits performed?

🔹 Regulatory oversight – Is the issuer licensed or audited by a financial authority?

🔹 Blockchain compatibility – Can the token be used in DeFi, exchanged, or self-custodied?

By evaluating these factors, investors can avoid speculative or poorly backed products and choose trusted digital bullion.

Comparing Today’s Top Gold Tokens: PAXG vs. XAUT

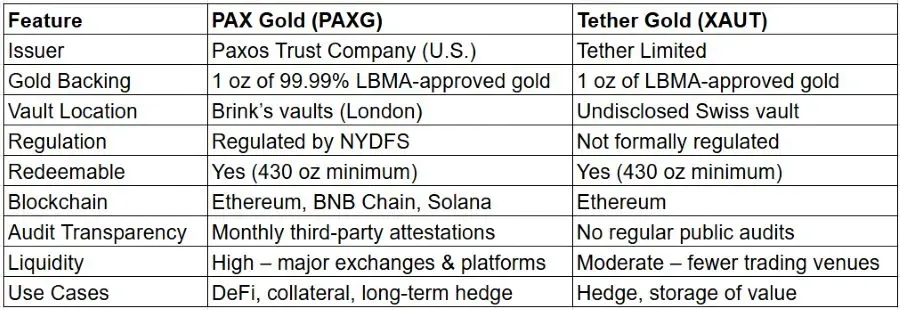

With the rise in tokenized gold demand, two leaders dominate the market in 2025: PAX Gold (PAXG) and Tether Gold (XAUT). Both offer 1:1 backing with physical gold—but differ in regulation, custody, and liquidity.

PAXG vs. XAUT: Side-by-Side Comparison

Why Tokenized Gold Makes Sense for Modern Investors

Tokenized gold isn’t just digital convenience - it enables new applications that traditional gold cannot. Today’s investors can:

🔹 Self-custody tokens in crypto wallets

🔹 Trade gold 24/7 on global crypto exchanges

🔹 Use gold as DeFi collateral

🔹 Buy fractional gold in units as small as 0.001 oz

In short, tokenized gold brings bullion into the digital age while preserving its core value as a hedge against inflation and uncertainty.

The Future of Gold Investing Is Hybrid

Tokenized gold is more than a passing trend - it represents the next phase of evolution for precious metals. As the financial world shifts toward digitized real-world assets, tokenized bullion gives investors the best of both: the stability of gold and the accessibility of crypto.

At Alpha Bullion, we help you navigate both sides of that spectrum. Whether you're stacking physical coins or exploring gold-backed tokens like PAXG and XAUT, we’re committed to helping you build a diversified, future-proof portfolio.

Other articles that may interest you:

Trump’s 401(k) Overhaul Could Bring Crypto and Gold Into Focus

Tether’s XAUt0 and the Rise of Gold-Backed Stablecoins